Expert legal advice on all aspects of Wills and Probate

Wills and Probate

Writing a Will is one of the most important things you can do in your life. It ensures your wishes regarding your money; possessions and property are carried out after you die. A Will can also be used to appoint legal guardians for your children who are under the age of 18 as well as to express your funeral wishes.

If you die without a valid Will in place it can cause unintended financial problems and emotional distress for your family. Without a Will Government Rules of Intestacy will apply to give structure to the distribution. These rules will be unlikely to reflect the real wishes of your estate and likely to cause significant delay to the distribution of your assets which can add to the distress to those who need timely access to money or property, such as a spouse.

Letter of Wishes

A Letter of Wishes is a separate document to your Will but is typically stored alongside it so that it can be read by the recipient after your death. The contents of a Will are legally binding, the contents of a Letter of Wishes are not. Its purpose is to provide guidance to executors, trustees and family members and provides an opportunity to set out your thought process either at the time of making the Will or at a later date.

A Letter of Wishes is a private document and unlike your Will, cannot become a public document if your Will goes to Probate after your death.

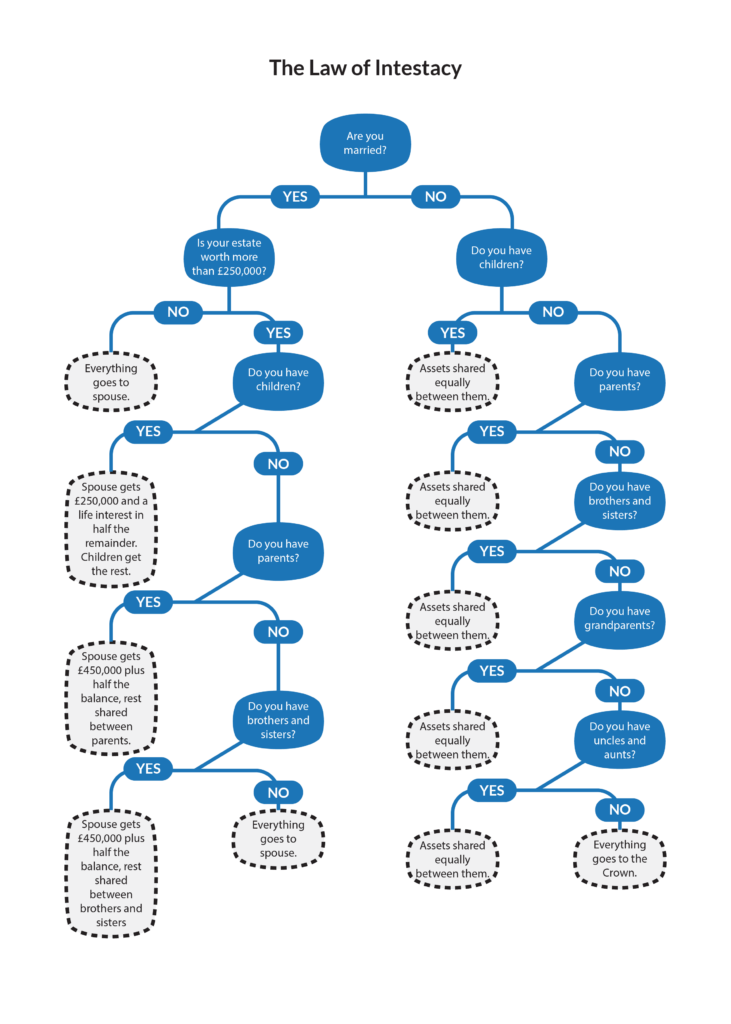

Government Rules of Intestacy

A person who dies without leaving a Will is called an intestate person. Only married or civil partners and some other close relatives can inherit under the rules of intestacy.

If someone makes a Will but it is not legally valid, the Government Rules of Intestacy decide how the estate will be shared out, not the wishes expressed in the Will.

This diagram shows how your estate would be distributed in this instance.

Please note:

- The issue (any child/children) of a pre-deceased member of a class (relation group) will inherit that share.

- Step relations have no entitlement unless legally adopted by the deceased.

- These rules are effective for deaths on or after 1 October 2014

- Property held as joint tenants passes to the other joint tenant, irrespective of the Rules of Intestacy.

- The Rules of Intestacy do not recognise ‘unmarried partners’ and therefore no provision is made for them.

Lasting Power of Attorney

A Lasting Power of Attorney (LPA) is a legal document that lets you appoint one or more people to help you make decisions or to make decisions on your behalf if you do not have the mental capacity to make decisions. The person who will make decisions on your behalf is called the Attorney. An Attorney can be family members, friends or a professional.

There are 2 types of Lasting Power of Attorney. The first allows your Attorney to make decisions relating to your health and welfare. The second allows your Attorney to make decisions regarding your property and financial affairs. You can choose to have a Lasting Power of Attorney document for one of both decisions.

Upon death the Attorney’s power to deal with your estate ends. Our Practitioners will be pleased to discuss Lasting Power of Attorney’s with you and help to complete and register them.

Probate

Probate is the judicial process whereby a Will is “proved” in a Court of Law and accepted as a valid public document that is the true last testament of the deceased, or whereby the estate is settled according to the Government Rules of Intestacy.

Once probate has been granted by the court, the Executors of the Will alongside the guidance and support of an experienced law firm (if the deceased had a valid Will) must collect in all assets and pay of all debts and distribute the estate in accordance with the terms of the Will. Executors are the people who must administer the estate. This includes ascertaining the value of all assets and liabilities of the deceased, preparing the Inheritance Tax form to be sent to HM Revenue and Customs, preparing an Oath for Executors, paying the correct amount of Inheritance Tax and probate fees and replying to any queries raised by the probate registry (part of the High Court) and HMRC.

If a person does not leave a Will, then the closest relatives must obtain a grant of letters of administration. The person or persons who do this are called the Administrators not Executors, However, they must act in the same way as Executors, dealing with all the matters which an Executor would deal with. However, the Administrators must deal with the Estate in accordance with the Government Rules of Intestacy.

Probate can be a complicated area of law which can cause distress at an already difficult to relatives of the deceased. Our experienced Probate team can relieve some of the strain and pressure by dealing with the necessary work in the administration of the Estate.

Trusts

Trusts may be created to protect funds of an individual and can be effective and efficient way of mitigating tax. Tax planning and Trusts are intrinsically linked as both help to protect the value of endowment you leave to your loved ones, whether it’s your spouse, children or grandchildren.

They may be set up in a person’s lifetime or in a Will to take effect on death.

There are many types of Trusts, including:

- Bare Trust

- Discretionary or Accumulation Trust

- Interest in Possession Trust

- Heritage or Charitable Trust

- Non-resident Trust

- Parental Trust for minors

- Vulnerable Beneficiary Trust

- Business Property Relief Trust

- Revocable Life Insurance Trust

- Asset Protection Trust

- Special Needs Trust

- Spendthrift Trust

- Tax By-pass Trust

Properly drafted, Trusts can fulfil your lifetime wishes, whilst having a considerable amount of tax. BES Legal Ltd put their years of experience and expertise into practice to decide whether a Trust will benefit your situation. We help with the set-up of Trusts, advise how to deal with HM Revenue and Customs and advise as to the costs of setting up a Trust and running it in the long-term.

Important Facts About Wills and Probate

- If you are living with a partner but not married (or in a civil partnership) the Inheritance Tax spouse relief which passes property to your spouse tax free DOES NOT apply, however long you have been living together.

- On marriage, all former Wills are automatically revoked. Beware; if you have made a Will in favour of your partner and then marry him/her, you MUST make a new Will, as the previous Will, will become invalid on marriage.

- If you get divorced, any gift to your former spouse takes effect as if your spouse had died on the date of your decree absolute. If you are merely separated, your spouse will still have the same rights as if you were still living together.

- There is a new nil rate band called main residence nil rate band which started in 2017, by which, individuals with direct descendants who have a main residence can pass a residence to a direct descendent on death and obtain a further £100,000 relief from inheritance tax.

- If you die without having made a Will, your whole estate WILL NOT pass to your spouse. The Government Rules of Intestacy will apply and your spouse will only receive £250,000 plus half of the remainder of your estate.

- Your debts do not die with you! Your executors will be liable to discharge your debts.

- If all beneficiaries agree, the provisions in a Will can be varied after death by way of a Deed of Variation, also known as a Deed of Family Arrangement.

- If you have given away your main residence to one or more of your children, or anyone else but continue to live at the property, on your death, for Inheritance Tax purposes it will be treated as if you never made the gift.

If you require information or assistance on any aspect of Wills and Probate, please contact us either by phone, e-mail or using the contact form below and we will get back to you as soon as possible.

Pricing

Download our probate fees document here.

Latest News

How safe is your Will?

Covid-19/Coronavirus – Our Policy

Make An Enquiry

If you would like to speak to one of our experts regarding your legal matter simply complete the form below and we will call you back.